In general, I’m in favor of capitalism.

I believe people have the right to work, buy, sell, and do business as they see fit. There certainly need to be rules. No social, economic, or political system can function without rules that are fair and well-enforced. That’s not a political statement. That’s just cold, hard realism.

In that same mold, I am not in favor of unmitigated capitalism in the mold that most libertarians and conservatives envision. I do not believe corporations, businesses, and industries should be given excessive leeway when it comes to dealing with fraud, failure, or environmental destruction. There needs to be some level of regulation to curtail the excesses of the market.

In my youth, I used to be a lot more libertarian in my views on how much or how little capitalism should be regulated. But as I’ve gotten older, I’ve become more aware of just how dangerous unfettered capitalism can be. You need only deal with Comcast’s customer service for any length of time to be convinced of that.

Now, I’m at an age where I feel like I’ve reached a new crossroads with respect to my view of capitalism. I won’t say I’ve completely lost faith in it or the idea. But I’ve seen way too many instances of big corporations doing objectively evil things to not be critical. And when they get in bed with political institutions, that evil only compounds.

Seriously, there are companies and state governments colluding to roll back child labor laws. This is not a joke. These companies want to make children work for them because it’ll result in greater profits.

This brings me to billionaires. They are the most celebrated figures in all of capitalism. They’re regularly ranked and whenever someone else becomes the world’s richest person, it generally makes the news. Like many others, I often celebrated their achievements too. I used to think that making a billion dollars, let alone over $100 billion, took a special kind of drive.

I admit I was wrong about that.

Now, I don’t think that billionaires, as a class, should even exist.

That may sound like a radical position. It’s often a talking point that comes up among those on the extreme left of the political spectrum. And those who espouse anything close to it are often ridiculed as being anti-business, anti-American, or outright communists.

Those criticisms are bullshit, by the way. They’re also just a distraction to avoid the distressing implication about billionaries.

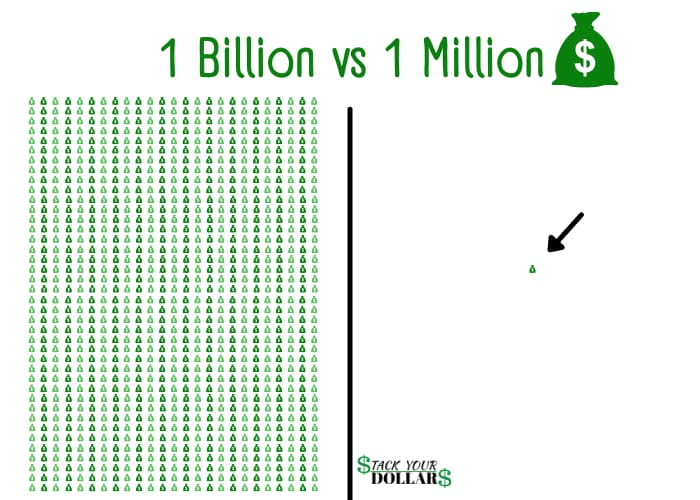

To understand, just take a moment to appreciate how much more a billion dollars is than a million dollars. I know those three extra zeros might not mean much to most people. But in simple mathematical terms, the gap is vast. In case you need something visual, here’s a quick image to help illustrate the concept.

Again, it’s not a trivial difference.

But if you need another way to conceptualize just how big a billion dollars is, consider the following.

One million seconds is about 11 days. Most of us can grasp that length of time.

One billion seconds is 31.5 years. That’s a third of an average person’s lifetime.

I hope that helps belabor the point because with that now in mind, ask yourself one critical question.

Is it humanly possible for anyone to work hard or long enough to justify having a billion dollars?

In the past, I might have considered that a dumb question. But now, I would answer that question with an emphatic no. I don’t care how smart, skilled, capable, or dedicated anyone is. The idea that someone even could work hard enough to earn a billion dollars just doesn’t work.

Again, look at the visuals above. The difference between a million and a billion is extreme.

It also helps to think back to the hardest, most laborious job you ever worked. Whether it was working in fast food, construction, or retail, just think about how hard that job was and how much it paid you. Now, consider how hard your boss worked and how much they got paid. Did the extent of their work actually reflect their salary?

In some cases, it might. But in most, I doubt it. Apply that to how much more billionaires make compared to even senior managers at a company and the disparity becomes even more absurd. If that doesn’t convince you, then maybe this video highlighting a speech by Jesse “The Body” Venture will.

Beyond just the work, take a moment to think about what it would take to spend that kind of money. How many houses could you buy that you could reasonably live in? How many yachts or ships could you buy and actually use in any meaningful extent? How much fancy jewelry could you buy and actually wear?

I’m sure there are those who think they could spend a billion dollars with ease. I doubt those same people truly understand how much more a billion dollars is compared to a million. And even if they could, it would take real, considerable effort to spend that kind of money in a single lifetime.

There’s also the argument that billionaires donate a lot of money to charity and that effort is worth their massive wealth. I used to think there was value in that too. But I’ve also come to see that endeavor as little more than virtue signaling laced with tax avoidance.

And finally, there’s the idea that billionaires are somehow special and they have a unique set of skills that somehow warrants them having that kind of wealth. That’s partially true, but not in a good way. If you just look at how most billionaires made their money, you’d notice that a lot of them either involve inheriting wealth that they didn’t do a damn thing to earn or being exceedingly ruthless in exploiting the labor of others and/or avoiding taxes.

On top of that, those with that level of wealth can literally afford to manipulate the system, legally and illegally, to ensure that their wealth and status is preserved. Whether it’s through tax loopholes or lobbying for laws that benefit them (and only them), billionaires can basically shape the world as they see fit, even if it hurts people, the environment, and everything in between.

Even if you’re in favor of capitalism, it’s hard to deny the corrupting factors that just a few billionaires could have. No system can work when it’s so top-heavy that just three people have more wealth than the bottom half combined. You can still have a functional, vibrant capitalist system that encourages entrepreneurs and wealth creation. You can also have a system that allows for billionaires. But you cannot have both.

As an alternative, I propose this.

Once you make a dollar over $999,999,999, that money gets taxed at 100 percent. And every year, the government sends you a nice trophy that says “Congratulations! You won Capitalism!”

If that much money and the trophy is still not enough for you, then you’re not just greedy. You’re an asshole and you can’t be trusted with millions of dollars, let alone a billion dollars.